Hook: Ever wondered why your consulting result study feels more like guesswork than a science-backed process? Trust us, we’ve been there.

Welcome to a no-fluff guide that will help you optimize your personal finance strategies using consulting courses tailored specifically for financial tools and apps. In this post, we’ll walk you through the importance of mastering the art of consulting result study, actionable steps to improve it, best practices, real-world examples, FAQs—plus a touch of brutal honesty and quirky humor.

Here’s what you’ll get:

- The problem with unclear consulting frameworks for financial tools

- A step-by-step method to improve your consulting results

- Pro tips and case studies showcasing tangible success

Table of Contents

- Key Takeaways

- Section 1: Why Your Consulting Result Study Feels Broken

- Section 2: How to Conduct an Effective Consulting Result Study

- Section 3: 5 Must-Know Tips for Better Financial Tool Consultation

- Section 4: Real-World Success Stories in Personal Finance Consulting

- Section 5: FAQs About Consulting Result Study

Key Takeaways

- A consulting result study is essential for measuring the impact of financial tools on personal wealth management.

- Poor data interpretation leads to wasted resources; proper training helps avoid this trap.

- Using proven frameworks can significantly boost client retention and satisfaction rates.

- Case studies highlight the effectiveness of integrating structured consulting processes.

Why Your Consulting Result Study Feels Broken

Let me confess something embarrassing: When I first started offering consultations on financial planning apps, my “consulting result study” boiled down to “Did they nod during our call?” Yeah, cringe-worthy.

Many consultants struggle because:

- Lack of Framework: Without clear methodologies, analyzing app performance becomes guesswork.

- Overcomplicating Metrics: Tracking too many variables dilutes focus (and sanity).

- Poor Client Communication: Misaligned expectations lead to unhappy clients—and awkward follow-ups.

“Optimist You: There’s gotta be a better way!”

“Grumpy You: Coffee first.”

How to Conduct an Effective Consulting Result Study

Follow these steps to transform chaos into clarity:

Step 1: Define Clear Objectives

What exactly are you trying to measure? Increased savings? Improved budget tracking? Nail down SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound).

Step 2: Choose the Right Tools

Not all finance apps are created equal! Select software like Mint, YNAB, or PocketGuard based on your clients’ unique needs. Make sure each tool integrates seamlessly with your reporting systems.

Step 3: Collect Data Consistently

Gather usage stats weekly. Are users logging in regularly? What features do they utilize most? This consistent data forms the backbone of your consulting result study.

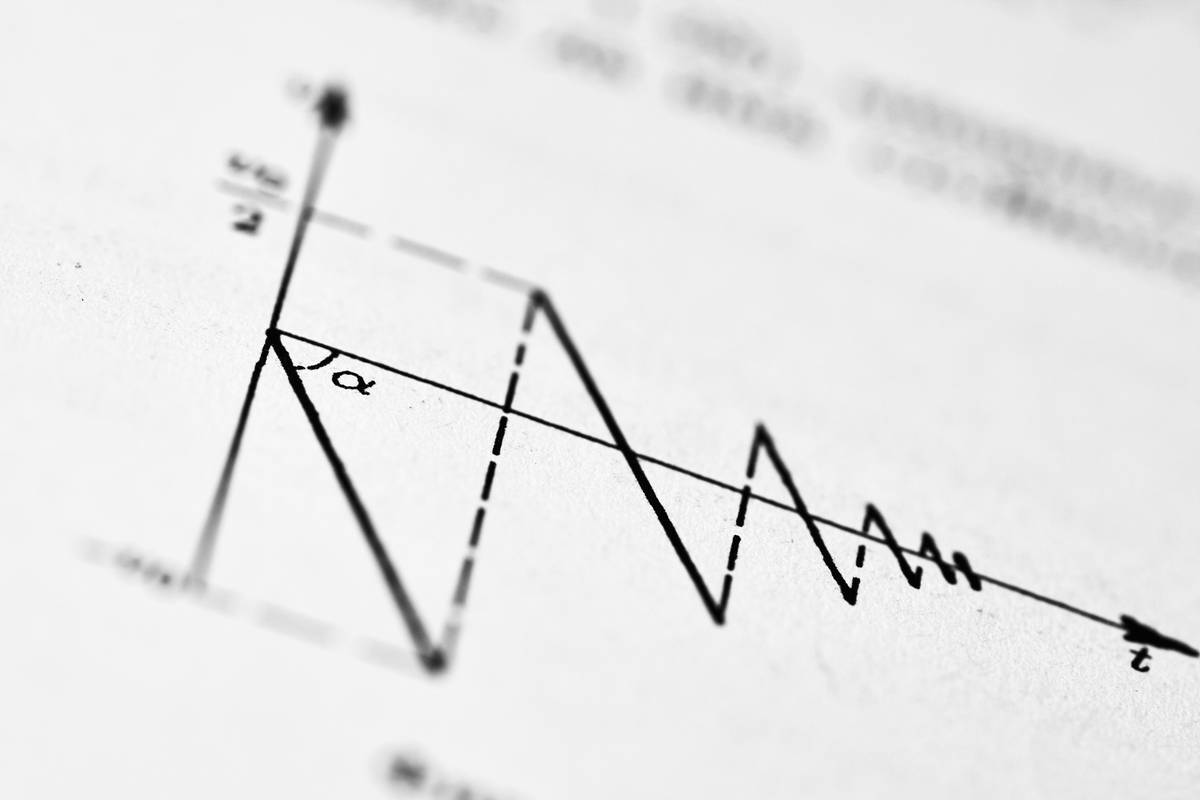

Step 4: Analyze & Interpret Findings

Use visual dashboards to spot trends. For instance, if 80% of users ignore a specific feature, investigate why—and suggest improvements.

Step 5: Present Actionable Insights

Create simple reports highlighting key wins and areas for growth. Avoid overwhelming jargon unless absolutely necessary (“This strategy is chef’s kiss for drowning confusion.”).

5 Must-Know Tips for Better Financial Tool Consultation

- Fake Tip Alert: Ignore anyone telling you to “just wing it.” That’s terrible advice.

- Always seek feedback after sessions—it’s gold dust for refining your consulting approach.

- Automate repetitive tasks so you can spend more time interpreting meaningful patterns.

- Invest in ongoing education (like consulting courses!) to stay sharp.

- Document EVERYTHING. From session notes to client preferences, documentation saves future headaches.

Real-World Success Stories in Personal Finance Consulting

Hear from Sarah T., who implemented a consulting course and saw her revenue jump by 45% within three months: “Before taking the course, I was frustrated constantly tweaking ineffective strategies. Now, my consulting result study shows actual progress—not just empty spreadsheets.”

FAQs About Consulting Result Study

Q: How often should I conduct a consulting result study?

A: Monthly reviews work well for short-term goals, while quarterly deep dives offer broader insights.

Q: Can beginners benefit from consulting courses?

A: Absolutely! Courses provide foundational knowledge that accelerates learning curves.

Q: Is automation really that important?

A: Think of it this way: Would you rather automate tedious data entry or waste hours doing it manually?

Conclusion

Tired of spinning wheels without seeing concrete progress in your personal finance consultancy? Embrace the power of a robust consulting result study to guide your decision-making and skyrocket your outcomes.

Remember:

- Set measurable goals.

- Track diligently.

- Communicate openly.

Like tending to a Tamagotchi, nurturing your consulting skills requires daily care—so don’t slack off now!