Ever stared at a blank spreadsheet wondering how to turn your financial expertise into a thriving consulting business? You’re not alone. Thousands of aspiring consultants struggle daily, feeling like they’re drowning in data without a clear path forward. But here’s the kicker: the right “consulting strategy blueprint” can transform chaos into clarity—fast.

In this post, we’ll explore how combining personal finance tools, apps, and high-quality consulting courses can unlock your full potential as a financial consultant. Spoiler alert: It’s easier than you think (and no boring spreadsheets required). By the end, you’ll know how to craft your own consulting strategy blueprint, avoid rookie mistakes, and even laugh at some hard-earned lessons from seasoned pros.

Table of Contents

- Key Takeaways

- Why You Need a Consulting Strategy Blueprint

- Step-by-Step Guide to Building Your Blueprint

- Tips for Mastering Financial Tools & Courses

- Real-World Examples of Successful Blueprints

- FAQ on Consulting Strategy Blueprint

Key Takeaways

- A consulting strategy blueprint is essential for aligning goals, resources, and client needs.

- Financial tools like Mint or YNAB work hand-in-hand with structured learning programs to boost your efficiency.

- Mistakes happen—but investing in proven consulting courses minimizes them.

- Actionable steps include identifying core skills, selecting tools wisely, and leveraging feedback loops.

Why You Need a Consulting Strategy Blueprint

I once launched my first financial consultancy armed only with a budgeting app and misplaced confidence. The result? A month later, I was stuck juggling clients who didn’t fit my niche, using tools that were overkill for their needs. Lesson learned: winging it won’t cut it in today’s competitive market.

An organized arsenal of financial tools makes all the difference.

That’s where a consulting strategy blueprint comes in. Think of it as the ultimate cheat sheet—a roadmap tailored specifically to guide your decisions. Whether you’re just starting out or looking to level up, having a blueprint ensures every move contributes directly to your long-term success.

Grumpy You: “Yeah, but make sure there’s coffee nearby when crunch time hits.”

Step-by-Step Guide to Building Your Consulting Strategy Blueprint

Step 1: Define Your Niche Within Personal Finance

Ditch the scattergun approach. Narrow down whether you want to focus on debt management, retirement planning, or another micro-niche. Then validate demand by checking Google Trends or forums like Reddit.

Step 2: Invest in High-Quality Consulting Courses

Bad Tip Alert: Don’t skimp on education because free YouTube videos look appealing. They often lack structure and depth. Instead, invest in reputable platforms offering specialized tracks, such as Coursera or Udemy.

Step 3: Identify Core Financial Tools

Select tools aligned with your niche. For example:

- Budgeting Apps: Mint, YNAB.

- Tax Software: TurboTax or QuickBooks.

- Client Management Platforms: HubSpot CRM.

Remember, shiny features don’t matter if usability tanks.

Step 4: Set Clear Goals

No one climbs Everest blindfolded. Break large objectives into smaller milestones—for instance, acquiring three new clients per quarter.

Step 5: Create Feedback Loops

Ask current clients what works and what doesn’t. Their input sharpens your consulting strategy blueprint immensely.

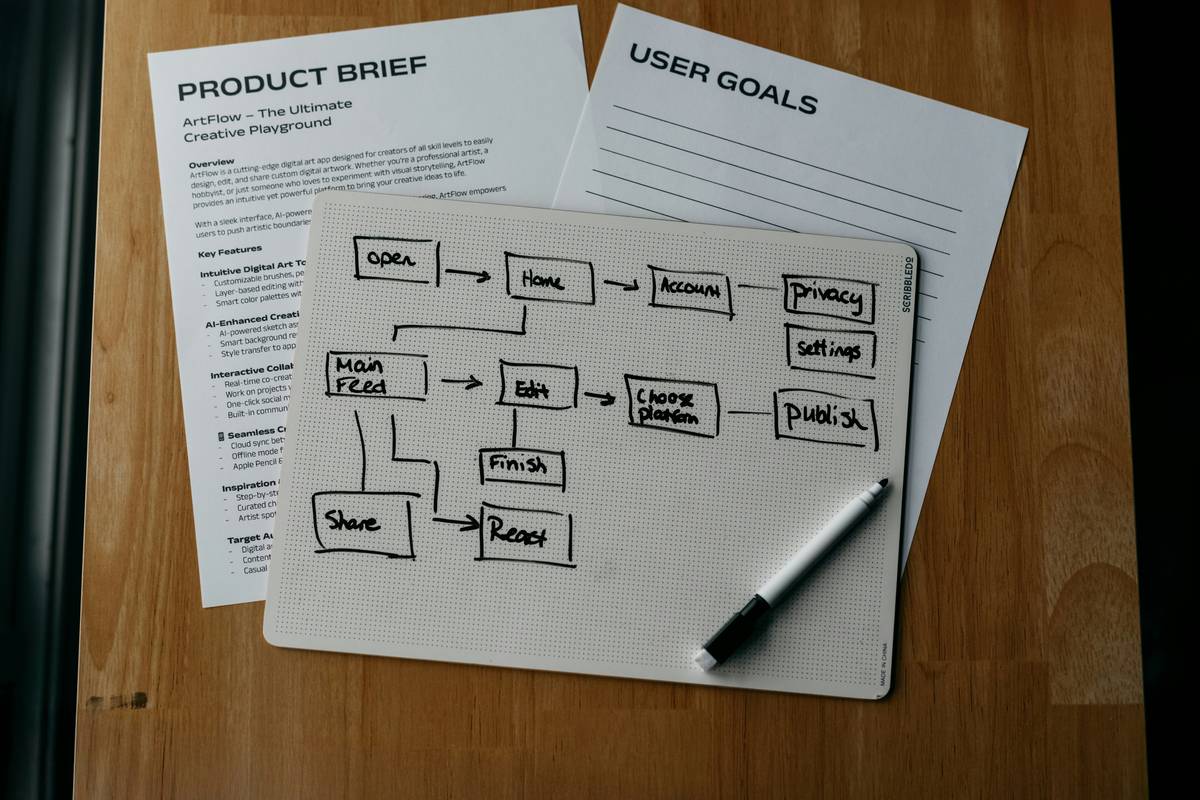

A flowchart visualizing the step-by-step process.

Tips for Mastering Financial Tools & Courses

- Start Small: Test each tool with mock scenarios before going live.

- Automate Repetitive Tasks: Use Zapier integrations to link software seamlessly.

- Track Progress Weekly: Regularly review course materials to stay ahead.

Real-World Examples of Successful Blueprints

Jessica, a former corporate accountant, revamped her career by creating a consulting strategy blueprint focused on helping millennials manage student loans. She used Tiller Money Suite for expense tracking and paired it with a certification in Financial Planning via Coursera. Result? Six figures within two years!

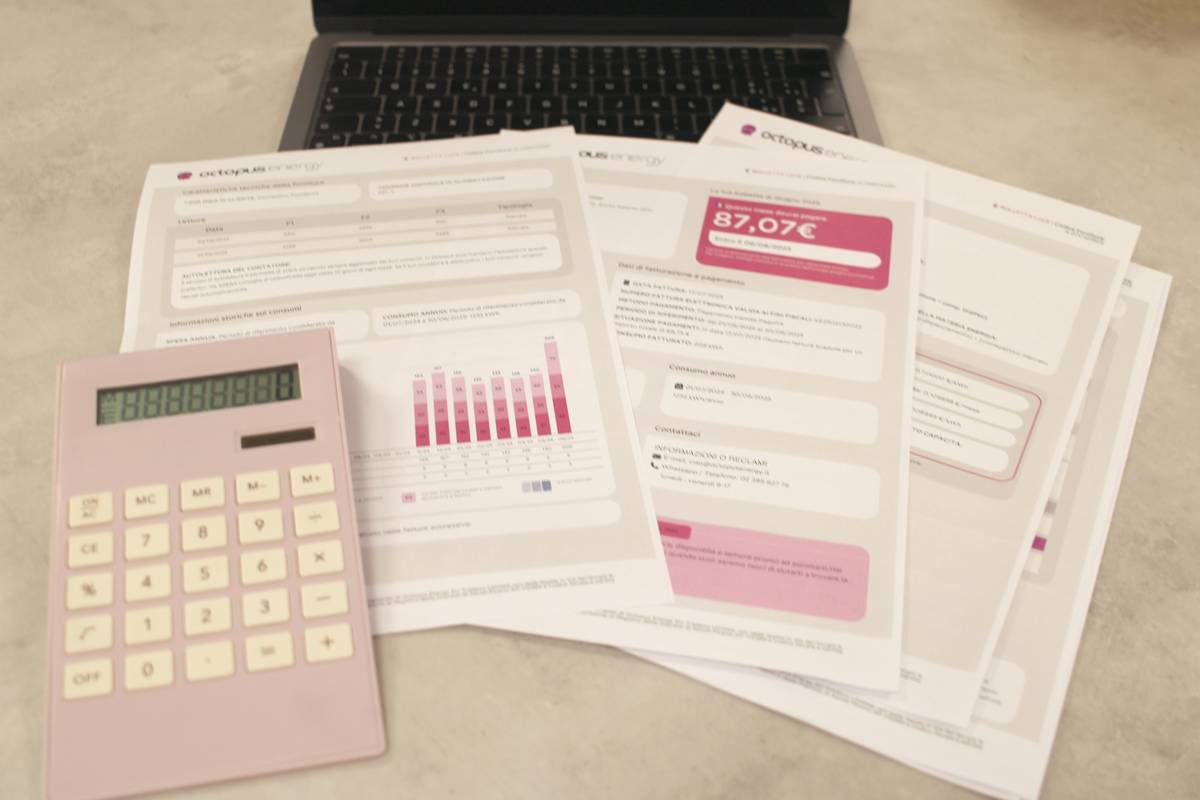

A chart illustrating income growth over two years.

FAQ on Consulting Strategy Blueprint

What Exactly Is a Consulting Strategy Blueprint?

It’s a comprehensive plan detailing how to position yourself in the market, target ideal clients, select tools effectively, and measure progress.

Can Beginners Handle This Process Alone?

Absolutely, though patience and persistence are key. Start small and scale gradually.

How Do I Know If My Blueprint Is Working?

Look for measurable outcomes—steady client acquisition rates, improved retention metrics, etc.

Conclusion

Your journey to becoming a top-tier financial consultant starts with having the right blueprint. Combine strategic planning, cutting-edge financial tools, and expert-led courses to carve out a space that’s uniquely yours. Remember, you’ve got this—but maybe stockpile some snacks along the way.

P.S. Like Pokémon cards back in the day, your consulting strategy blueprint grows stronger with time and care. Keep refining it!