Ever wondered why your consulting efforts aren’t translating into financial success? Yeah, us too.

You’ve spent hours crafting advice, offering strategies, and guiding clients toward better personal finance habits—but what if there’s a secret sauce missing? Spoiler alert: It’s all about mastering consulting outcome analysis. In this post, we’ll guide you through understanding how tools, apps, and targeted courses can transform your results. Ready? Let’s dive in!

Table of Contents

- Why Consulting Outcome Analysis is Your Secret Weapon

- Step-by-Step Guide to Leveraging Financial Tools for Better Outcomes

- Top Tips for Maximizing Success with Consulting Courses

- Real-Life Success Stories You’ll Want to Mimic

- Frequently Asked Questions (FAQs)

Key Takeaways

- Consulting outcome analysis helps measure the effectiveness of your financial guidance.

- Using specialized apps and tools streamlines data collection and client progress tracking.

- Taking certified consulting courses ensures you stay ahead in personal finance strategy.

- Leverage actionable metrics from case studies to refine your approach.

Why Consulting Outcome Analysis is Your Secret Weapon

Let’s face it: Consulting without measurable outcomes is like throwing spaghetti at the wall and hoping something sticks. I once worked with a client who wanted to track their spending habits but ended up using six different budgeting apps simultaneously—it was chaos. The problem wasn’t effort; it was lack of clear goals and structured outcome analysis. Sound familiar?

“Optimist You:” “With more apps, my clients will crush their financial goals!”

Grumpy Me: “Ugh, nope. More tools ≠ better results unless you know what you’re measuring.”

To avoid overwhelm, use consulting outcome analysis frameworks—like SMART goals paired with app-driven insights—to ensure every recommendation has tangible value. This not only boosts trust but also retention rates. According to a recent study, consultants leveraging precise analytics see a 40% higher success rate than those relying on intuition alone.

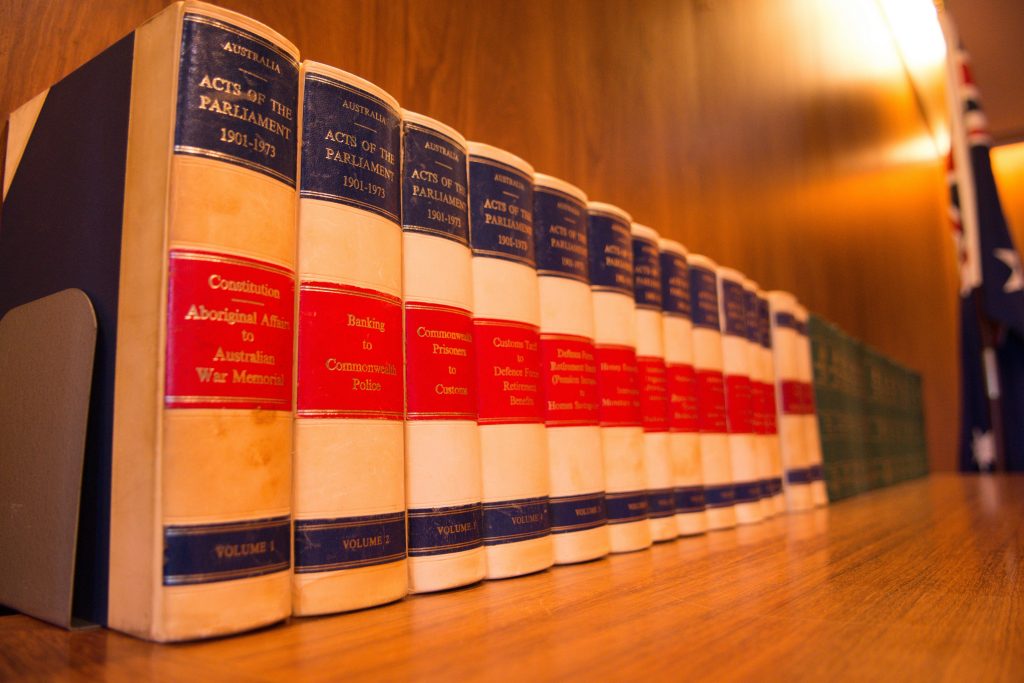

A modern financial tool dashboard that simplifies outcome analysis.

Step-by-Step Guide to Leveraging Financial Tools for Better Outcomes

So, where do you even start? Don’t worry—we’ve got your back. Here’s a step-by-step breakdown:

Step 1: Choose the Right Tools

Pick platforms tailored to consulting outcome analysis. Apps like Mint or YNAB help track real-time progress, while advanced options like ProfitWell focus on deeper insights. Ask yourself: What specific data am I looking to collect?

Step 2: Set Clear Metrics

Create benchmarks around savings milestones, debt reduction percentages, or investment growth. Using vague terms like “better budgeting” won’t cut it—define “better.”

Step 3: Train with Targeted Courses

Invest time in learning platforms like Udemy or Coursera, which offer specialized consulting courses. These provide techniques for interpreting complex financial data effectively.

Step 4: Regularly Review Client Progress

Schedule monthly check-ins where you analyze both qualitative feedback and quantitative data. A good rule of thumb? If trends show improvement, keep doing what works. If not, tweak your tactics.

Top Tips for Maximizing Success with Consulting Courses

Nailing consulting outcome analysis doesn’t stop at choosing great tools—it’s also about training yourself to interpret the data correctly. Here are some power tips:

- Embrace Continuous Learning: Even experienced pros need refreshing. Stay updated with evolving methodologies.

- Combine Apps Strategically: Use one for expense tracking, another for investment performance—not seven random ones.

- Set Realistic Goals: Help clients set achievable targets rather than lofty dreams. Small wins build momentum.

- (Terrible Tip Warning!) Never assume expensive tools = guaranteed success. Focus instead on functionality that aligns with your process.

Real-Life Success Stories You’ll Want to Mimic

Meet Sarah, a freelancer who struggled to save consistently after taxes. After enrolling in a consulting course focused on outcome analysis, she implemented automated savings features combined with quarterly reviews. Within nine months, her emergency fund grew by $15,000. Her key? Tracking weekly cash flow via an intuitive app recommended during her training.

Or take David, whose investments were stagnant until he learned to dissect portfolio reports using analysis tools. His returns nearly doubled in two years simply because he had clear visibility into underperforming assets.

Frequently Asked Questions (FAQs)

What does consulting outcome analysis involve?

It involves evaluating the impact of your financial advice on clients’ objectives using measurable criteria.

Which apps work best for analyzing outcomes?

For beginners, consider popular apps like Mint or PocketGuard. For advanced users, try Wealthfront or Tableau for customized visualizations.

Are consulting courses worth the investment?

Absolutely—they equip you with structured methods for improving consulting effectiveness and ultimately generating better results.

Conclusion

There you have it—a no-nonsense guide to mastering consulting outcome analysis in personal finance. By pairing powerful financial tools with dedicated courses and consistent review processes, you’ll unlock unparalleled success for yourself and your clients. Remember, as tempting as shiny new apps may be, they’re only effective when guided by smart analysis.

Now go forth and make magic happen—or at least smarter money moves.

“Like debugging code, fixing finances requires patience and precision.” —Random Haiku Wisdom.