Ever wondered why your consulting projects feel stuck in neutral? You’re not alone. The average consultant spends 3x more time tweaking their workflows than actually delivering results. Whether you’re struggling to quantify your impact or can’t find the right tools, mastering the consulting outcome study is your golden ticket to proving real value—for both your clients and yourself.

In this guide, we’ll dig into how financial tools and apps—paired with courses designed for consultants—can revolutionize your approach to client success. By the end of this post, you’ll learn:

- What a consulting outcome study is and why it matters.

- Step-by-step ways to leverage financial tools effectively.

- Top courses that align with building measurable outcomes.

- Real-world case studies (with lessons learned).

Table of Contents

- Key Takeaways

- Why Most Consultants Struggle Without a Clear Outcome Study Framework

- How to Use Financial Tools to Build Stronger Consulting Outcomes

- Best Practices for Conducting an Effective Consulting Outcome Study

- Real-Life Examples: Successful Consulting Outcome Studies

- Frequently Asked Questions About Consulting Outcome Studies

- Conclusion

Key Takeaways

- A consulting outcome study helps measure tangible benefits from consulting interventions.

- Financial tools like Mint, QuickBooks, and Tiller are game-changers for organizing data and reporting outcomes.

- Investing in tailored consulting courses boosts strategic thinking and quantitative analysis skills.

- Real-world examples highlight actionable insights for replicating success.

Why Most Consultants Struggle Without a Clear Outcome Study Framework

Let me tell you a story. Early in my consulting career, I once spent six months working on what I thought was “the perfect plan” for a client’s financial inefficiencies. End result? A beautifully written report… and zero action taken by the client. Oof.

“Optimist Me:” “But look at all those pretty charts!”

“Grumpy Me:” “Yeah, but did they even implement anything?”

The problem wasn’t just poor planning; it was failing to create a clear outcome study framework. Clients want evidence—not promises. They need proof that hiring you will move the needle. Enter the consulting outcome study: a mix of analytical rigor and storytelling that ties your work directly to measurable results.

With so many moving parts in personal finance management, relying solely on Excel isn’t going to cut it anymore. This is where modern financial tools come in—and understanding them can be transformative.

How to Use Financial Tools to Build Stronger Consulting Outcomes

Step 1: Choose the Right Tool for Data Collection

Start by identifying which tool best fits your needs. Here’s a quick breakdown:

- Mint: Ideal for tracking expenses and budgets.

- QuickBooks: Perfect for invoicing and accounting tasks.

- Tiller: Best for customizing Google Sheets templates.

Step 2: Organize Your Metrics Around Key Goals

Create categories based on specific objectives such as cost reduction, revenue growth, or debt elimination.

Step 3: Analyze Patterns Over Time

Use these tools’ visualization features to identify trends, anomalies, and opportunities for improvement.

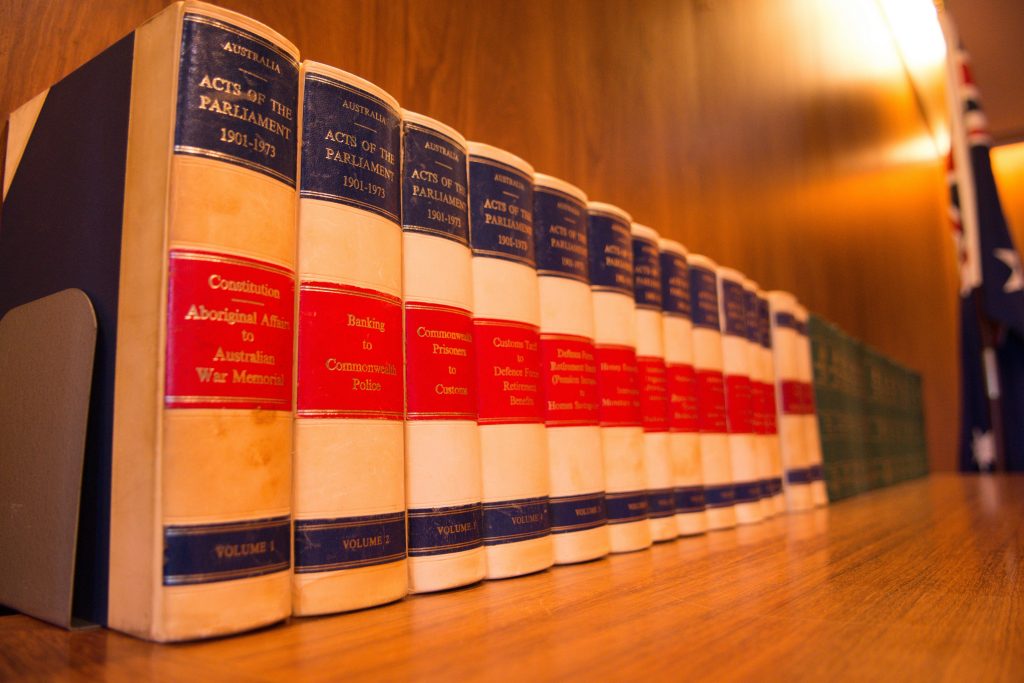

![]()

This step ensures you have a rock-solid foundation before presenting findings to your client.

Best Practices for Conducting an Effective Consulting Outcome Study

- Get Buy-In Early: Make sure stakeholders understand the “why” behind the study.

- Be Ruthlessly Honest: If something didn’t work, own up to it—but explain why.

- Visuals Matter: Charts beat walls of text any day.

- Pick One Terrible Tip: Don’t try to solve every issue at once. Focus!

Rant Alert: Nothing annoys me more than consultants who promise moonshots without grounding recommendations in reality. We’ve all seen people pitching ideas that sound great in theory but fall flat in practice. Let’s avoid being one of them.

Real-Life Examples: Successful Consulting Outcome Studies

Case Study #1: From Chaos to Clarity with Mint

Client Profile: Small business owner overwhelmed by cash flow issues.

Outcome Study Approach: Implemented Mint to categorize expenses and set monthly alerts.

Result: Client reduced unnecessary spending by 20% within three months.

Case Study #2: Scaling Revenue with QuickBooks Automation

Client Profile: Freelancer struggling to manage invoices manually.

Outcome Study Approach: Migrated to QuickBooks for automated billing reminders and payment integrations.

Result: Increased on-time payments by 35%, leading to smoother operations.

Frequently Asked Questions About Consulting Outcome Studies

FAQ 1: What exactly is a consulting outcome study?

A consulting outcome study measures the tangible impacts of your interventions through quantitative metrics and qualitative feedback.

FAQ 2: Are there free tools available for conducting these studies?

Yes, tools like Mint or Wave offer robust free versions ideal for smaller-scale projects.

FAQ 3: Do I really need to take a course to learn about this stuff?

If you want to stand out in the crowded market, yes. Expertise speaks volumes, especially when backed by certification.

Conclusion

In summary, mastering the consulting outcome study requires combining smart tool usage with targeted learning via specialized courses. With frameworks, financial apps, and professional development aligned, you’re set to deliver undeniable value. Now go forth and transform your consultancy—just maybe grab some coffee first.

Oh, and here’s a little treat for making it this far:

Numbers crunch loud Tools help show true growth paths Consultants level up

Cheers to leveling up—like upgrading from Tamagotchis to smartphones.